19800 Macarthur Pl

Irvine, CA 92614 US.

Mon - Sat 10:00 am - 7:00 pm

Sunday CLOSED

LET'S FLIP YOUR

CREDIT SCORE TODAY!!

- NATION'S #1 LEADING CREDIT REPAIR SERVICE

- COMBINED WITH 20+ YEARS OF EXPERIENCE

- LATE PAYMENTS

- COLLECTIONS/CHARGE-OFFS

- TAX LIENS

- DEBT NEGOTIATION

CALL TODAY FOR

A FREE CONSULTATION

START REPAIRING YOUR CREDIT IN 3 EASY STEPS!

Whether you're new to credit or looking to advance your skills, get to the next level with one of our comprehensive courses.

Step 1

Get started now on your way to fixing your credit scores by filling out our FREE credit audit form or stopping by our Los Angeles office. You’ll be glad you did.

Step 2

Our goal is to raise your FICO credit scores in order to help you rebuild your credit. We have an experienced staff who goes the distance for our clients. Our processing department is unsurpassed in customer satisfaction. These are just a few reasons why we are leading the industry in California credit repair and debt negotiation.

Step 3

We even have a Money Back Guarantee – We will help repair and fix the items on your credit report or you don’t pay. We serve the Southern California area including Los Angeles, Orange County, the San Fernando Valley, and the Inland Empire. Get started today on fixing your credit and improving your credit score.

What can GREAT credit give you?

Lower Interest rates

The interest rate is one of the costs you pay for borrowing money and, often, the interest rate you get is directly tied to your credit score. If you have a good credit score, you’ll almost always qualify for the best interest rates, and you’ll pay lower finance charges on credit card balances and loans. The less money you pay in interest, the faster you'll pay off the debt and the more money you have for other expenses.

Approved for Higher Limits

Your borrowing capacity is based on your income and your credit score. One of the benefits of having a good credit score is that banks are willing to let you borrow more money because you’ve demonstrated that you pay back what you borrow on time. You may still get approved for some loans with a bad credit score, but the amount will be more limited.

Better car insurance rates

Add auto insurers to the list of companies that will use a bad credit score against you. Insurance companies use information from your credit report and insurance history to develop your insurance risk score, so they often penalize people who have low credit scores with higher insurance premiums. With a good credit score, you’ll typically pay less for insurance than similar applicants with lower credit scores.

Credit Card Perks

Credit card rewards exist to encourage you to use your credit card, and they're very persuasive indeed. With a simple flat-rate card that pays the same amount on every purchase, you can get back 1.5% or even 2% of every dollar you spend, either as cash or as points or miles to redeem for travel or other things. Spend $1,000 a month, and you could earn $180 to $240 a year without any special effort.

Renting an appatment

More landlords are using credit scores as part of their tenant screening process. A bad credit score, especially if it’s caused by a previous eviction or outstanding rental balance, can severely damage your chances of getting into an apartment. A good credit score saves you the time and hassle of finding a landlord that will approve renters with damaged credit.

Avoid Security Deposits

These deposits are sometimes $100 to $200 and a huge inconvenience when you’re relocating. You may not be planning to move soon, but a natural disaster or an unforeseen circumstance could change your plans. A good credit score means you won’t have to pay a security deposit when you establish utility service in your name or transfer service to another location.

Puts you in your dream HOME

Even if you have a good income, a solid job history, and some savings for a down payment, a poor credit rating can derail your homebuying dreams. The lower the credit score and rating, the harder it will be to secure a home loan. Even if you do manage to get a loan, you’re likely to be charged a higher interest rate and will probably have to come up with a bigger down payment.

Approval for Certain Jobs

Some jobs, such as those that work with money or in security clearance positions, require a personal credit check. This is to make sure that you’re capable of handling finances, or that you’re not vulnerable to bribery because of financial problems. If you have a poor credit score, you may not qualify for certain positions.

Testimonials

Kristal had been struggling with her credit score for years. She had tried to increase it but nothing he did seemed to work. Then she found Flip Your Credit, an online program that promised to help her improve her score. After signing up and following the steps in the program, Kristal was amazed at how quickly her credit score began to rise. Within a few months, her score had increased by over 100 points! She credited Flip Your Credit for helping her improve her financial security and get the loan rate that he wanted. Kristal is so grateful for the help Flip Your Credit gave him in improving his score and would recommend it to anyone looking for a reliable way to raise their credit score.

Our Partners

Leading the way in building long lasting credit

642

Helped Improve Score

87

Online Reviews

54

Helped Finance

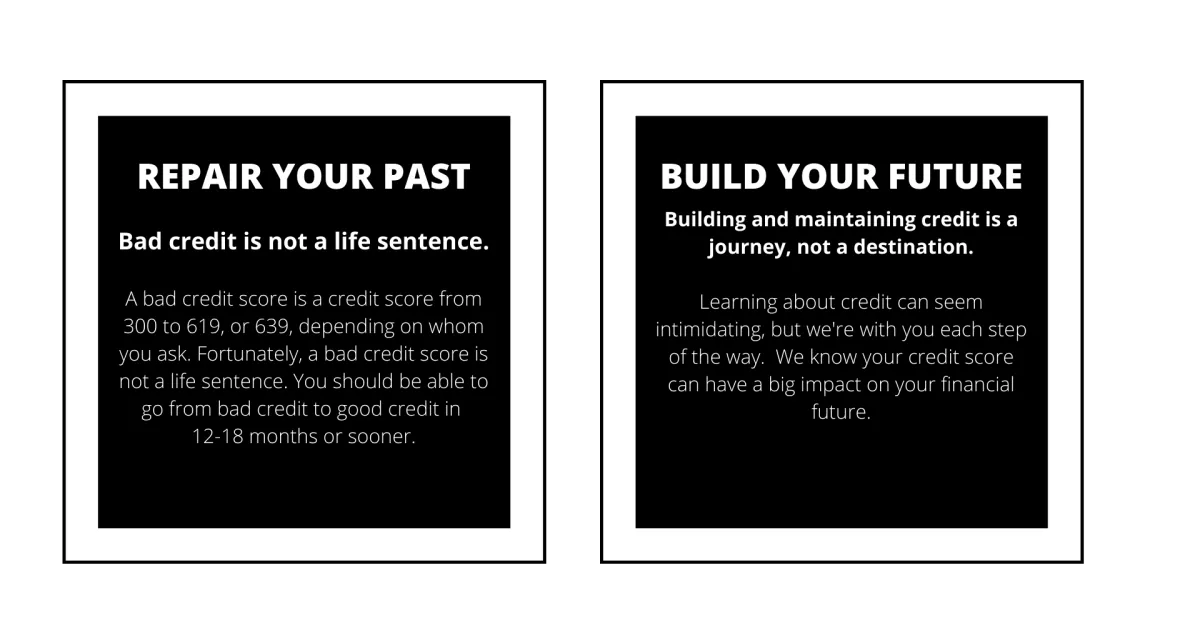

about Flip Your Credit

Flip Your Credit (FYC) is a premier credit repair and debt relief service that helps you gain financial freedom. With our team of experienced experts, we can help you improve your credit profile and restore your financial standing. We understand the unique needs of each client and strive to provide personalized solutions to meet those needs. No matter how bad your credit score is, we can help you get back on track and start living the life you’ve always wanted.

© 2021 - 2024. All rights reserved by Flip Your Credit LLC.